Why not link the actual ordinance and we’ll take a look to confirm

Minimum wage was increased to $15 per hour in NYC only. The rest of the state is going to get $12.50. The propaganda coming out of this state would also have you believe that medical marijuana is legal. But it’s not. Your allowed to buy it.

There is a difference.

LMAO is this Cuomo’s plan to distract from killing grandma with his shit polices or his sexual assault allegations? Get the people outraged at taxes, the dummies will celebrate getting permission from the very same people who extort and violate us, media will cover for him and all trouble is gone. It’s amazing how a certain party can get away with anything, while being hailed as virtuous.

… and some of y’all still willing to work with LE and the government.

Enjoy the extortion!

Heya bud, you kinda sound like a conspiracy theorist ya know.

![]()

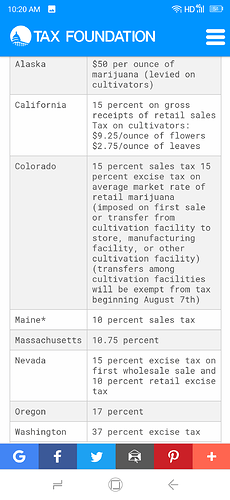

Having lived in NY for 20 plus years and being a tobacco/vape distributor I have never once for the life of me understand the thinking about NY taxes neither I have met a real legit distributor who agreed or understood the reasoning behind.

NYC is black market capital of cigarettes. Every other store sells unstamped or out of state cigs. They haven’t been able to do jack about this until recently when they started taking away lotto licenses and stopped issuing new licenses to establishments that had been ticketed thrice regardless of the new ownership.

Now people sell cigs without even having a license at retail level. After years of lobbying by cigar companies and OTP distributors the tax on cigars was brought down to 28% wholesale…recently it was increased to 75%.

PA has no tax and no reporting requirements. People risk breaking the law because you can make a killing by simply breaking it…duh.

Connecticut is the same. Really high taxes on cigs. If you break the law…get caught with a million dollar worth of inventory yet you get fined few thousand dollars and you go on…really shit laws.

taxes in place that actually achieve the opposite of what these states are trying to do. Don’t know when they will learn.

Sometimes things are just (D)ifferent. ![]()

Well, someone’s gotta pay to rebuild the city after the burning and pillaging, I mean peaceful protesting.

Governor rapist already got his bailout from the feds though.

80$ per active gram, wow wow we wow.

I hope I am reading this wrong.

I heard NY was expensive but damn…

Get high or go broke trying.

Reread the OP. It’s .05 of a cent per MG. Not 5 entire pennies

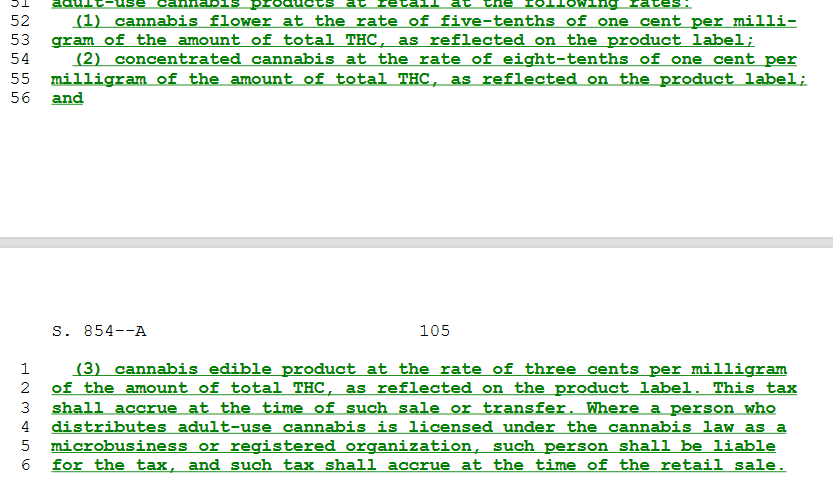

Yup. Here’s the bill language:

So If I’m doing my math right, if an ounce is 20% THC, that’s 5600mg. That times the tax rate would be $2.80 of tax on that ounce.

Edit: I suck at math. Should be $28 of tax on that ounce.

Is that at the retail level though?

That I’m not sure. I’m not the best at reading tax law but here is a link to the entire bill: https://legislation.nysenate.gov/pdf/bills/2021/S854A

Tax structure starts on page 105

I think it’d be $28 of tax @ a 20% / oz

5600 * half a cent

yup, I’m wrong. Had the decimal place in the wrong spot.

So does the OP.

.05 cents per milligram THC for buds

.08 cents per milligram THC for concentrates

.03 cents per milligram THC for edibles

13% sales tax on top

.05* 300mg(30% thc) = $15 a g of tax per gram pre sales tax

.08* 850mg = $68 of tax before sales tax.

Should be .005* 300mg = $1.5 per gram @ 30% THC

and .008 * 850 =$6.8/g @ 850mg THC/g

I read .05 and .08 off the blacklists page, that’s on me for not checking the legislation. Based on that pic I am a decimal point off. Very happy to be wrong about that, sorry for stirring the pot for cheaper taxation than cali!

Deleted