Made some remarks in response to @Ncfarmer and was going to mention Dhydra Technology who I see was mentioned here:

Thoughts on whether the drying segment is a business in and of itself?

Would the potential mistakes you think people will make be in line with what I was speculating in my response? Aka, farmers getting beat up on prices, extractors getting beat up on processing woes from capacity not fit to handle higher water content material.

Did some reading in a separate thread about membranes. More reading to do ref centrifuges.

Great azeotrope thread started here by @Photon_noir for future readers (too n00b to come to any sound conclusions yet ![]() ):

):

Would you say there is a certain scale of operation beneath which it doesn’t make sense? So a refinement to the discussion is “what is best at a certain scale” vs. simply “what is best”. From your final comment it sounds like our budget is adequate to initiate with this type of system, but could we at half that budget, for example.

Our idea is to strategically select one part of the entire processing line that is not as capital intensive to get into, has adequate supply/ demand dynamics, and may quickly generate a return, so the line itself can pay for its own expansion. This is the lean end of the continuum from the risk @Mont7071 pointed out about too much shiny new equipment.

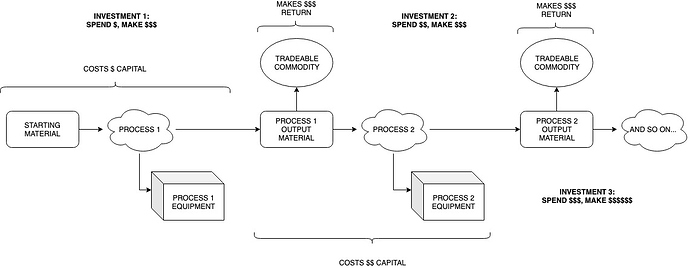

I’ve attached a concept drawing of what I’m referring to, devoid of the particular processes themselves, focused purely on the economics. Of the 3 possible investments, what we are interested in is Investment 1, Bang for your Buck. Many outfits are probably Investment 3 outfits. We want to grow that infrastructure via Investment 1’s ROI. We’d like to avoid Investment 2 except to the extent it is necessary for achieving scale/ total vertical integration.

In #1, the investor triples their money.

In #2, they make 50% on their money, and their startup costs double.

In #3, startup costs triple, and the investor doubles their money. But it’s big money and the eventual outcome of a successful enterprise.

So the question is, in the entire processing line, what are the potential segments with Investment 1 dynamics: low startup cost, high market value add going from the starting material to the process output, and the output being a marketable commodity in its own right. There are surely some segments where more marketable outputs are produced versus others. And there is surely better investment return potential relative to the capital intensivity of building capacity in each respective segment. Or perhaps we’re crazy and unless you’re totally vertically integrated you’re not producing anything anyone is interested in.

The same concept in real estate would be where painting the walls costs you hundreds yet makes you thousands in property appreciation. You do that to flip the house versus replacing the roof.

Happy to elaborate if the drawing is too cryptic. Mindmaps are how I think but it seems many people can’t stand them. ![]()