Hello all, new member of this awesome community.

Have read intensely through many threads the last two days, do not have a background in the space, rather pharmaceuticals on the corporate finance side. Have not yet put together all the conceptual pieces of building a hemp CBD processing line, anticipating a budget circa $5-600k.

We don’t anticipate backwards integrating into cultivation and would like to have capacity in anticipation of our market’s development not after the fact. We will budget anticipating out-of-state material purchase for our own account to sell locally/ nationwide post processed. As our market gets going we intend to provide tolling services to the local farming community.

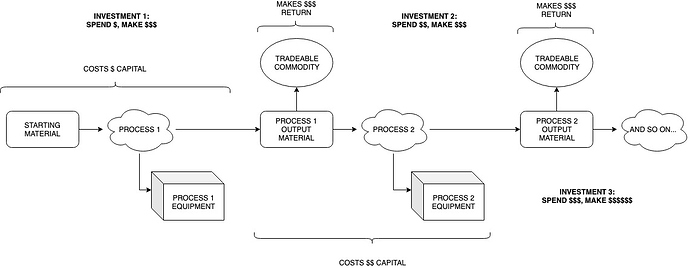

What we would like to determine is whether there are options relative to where we begin building out our toll processing line that best match current market demand for those services, the resulting material and the value creation/ “bang for your buck” from the investment. Potentially poor examples based on what we’ve learned so far might be: (1) buy an FFE + ancillaries, buy out-of-state crude, sell our distillate in-state/ nationwide. Profits fund next stage of buildout. (2) Buy ethanol extraction portion of the line, buy out-of-state biomass, sell our crude in-state/ nationwide. (3) Etc.

We’ll want to have our services begin where the local farmers’ needs begin, once there is local cultivation, however before our market is established we have the ability to strategically initiate our processing line investment into the best return-on-investment/ rate-of-return portion of the line and let the lab self-fund or pay into its own up/ downstream expansion.

Any thoughts from folks far more experienced than a pharma “numbers cruncher” on this concept or which portion of the line might be the best place to start would be greatly appreciated.

Look forward to embarking on this adventure with y’all! ![]()