you might want to read what people who actually take it say, not just ivory tower “medical professionals”…

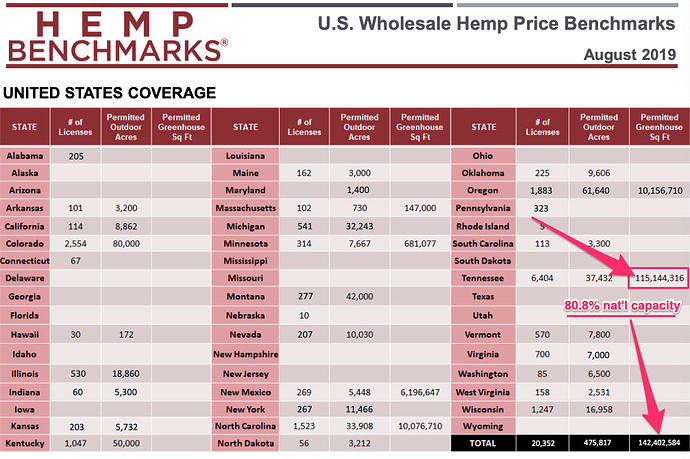

Some huge greenhouse players in TN…

Does anyone know what the daily capacity of processing is in the US? I know there are some big facilities being built but does anyone tract that?

What part?

What part of TN? Not sure, and only in terms of permitted SF.

Perhaps “huge prospective players” would have been more appropriate.

From the article you linked:

Ha… I dOnT ReAd GoOd

Thats only 2600 acres. Thats not much.

Considering how dilute those mg concentrations are a small dip may be good. I’m lucky to have access to cheap wholesale cbd products. But considering a 100$ bottle of cbd tincture has 500 mg cbd most people cant afford to take an actual medicinal dose. IMO most consumer products are just hype and serve as bragging rights to those that take them. I would need to eat 5 whole bags of gummies to get any sort of long term benifit, and it would probably be negated by the ensuing diabetis.

I am currently an extractor and we get our material at a price that is more profitable to farmers as a crop than others. Then we sell it at not much of a boosted margin. But a retailer that can get 1 gram for 3$ and mix mct into it and get nearly 200$ retail is sort of rediculous, and shows an ignorant hype based market.

Agreed, lots of hype and very little value for much of the consumer market.

This is terrifying. Do you have a source for this info?

Hemp Farming I expect will see a huge dip and we will see lots of smaller farms dropping off, and will likely feel the biggest hits.

CBD isolate and distillate only wholesalers and labs I would expect to also see drops in net profit. The labs which were built on inventor funds which over-hyped expected returns will likely see bank runs with their investors and fail.

Seed-to-retail, vertically integrated companies will have a fighting chance depending on their marketing, branding, and overhead. I foresee the retail market becoming a massive battle of the brands.

Toll processors might have a shot. Analysis labs should be ok as the industry lives and breathes by lab results, however analytical labs are a much slower ROI in exchange for security.

Minor cannabinoids and synthesized cannabinoids will likely see some stability depending on demand. supply, and ease of production.

Smokable hemp might be the farmers last hope, should the demand stay high and scalability of compliance is legitimate. Though I imagine this market will get flooded as well.

Is it a bad time to be in the hemp industry? Probably, but in a totally subjective and case by case basis depending on the organization and their strategy.

Price crash eminent? Lol last year the economist projected this, 2.6 billion dollar industry they say. Let’s do simple stupid, math lets say most of that is retail and in a price drop where 1000mg tincture gets sold at retail for $25. 2,600,000,000 divided by 25 is 104000000 divide that by 1000 and you get 104000 kgs of cbd needed. Say half of that is isolate half and half is full spectrum distillate. Acreage for distillate is 52000kg times 1.2 which is 62400 liters times 33 is 2059200lbs divided by 2000lbs per acre is 1029.6 acres for the u.s. full spectrum distillate consumption. Isolate lets say 65% return, 1.35 times 52000kg is 84240kg then times 1.2 which is 101088 liters times 33 which is 3335904lbs divided by 2000lbs per acre so that’s 1667.95 acres for the u.s. consumption of isolate. I could be way off, but this is what I believe is close to the us acreage needed to supply the projections given by economist.

2697.55 acres is all the us needs. Granted this doesn’t account for smokable hemp but I believe the difference is negligible in this scenario. So fuck. Obviously that math was written and thought out sitting in my car at a gas station so I could be wrong, I hope I am. But even if you go with other projections like rolling stone etc they say 22 billion, roll that decimal point over once and we’re at 26k acres. That’s suk le vue. The network of people I know account for well over 2k acres. ![]()

![]()

![]()

![]()

![]()

Imminent? Ongoing.

Depends on your angle. Cbd imminent. Market will expand but once hemp production moves into investment of making other retail products like plastics, sugar, flour, toilet paper, and fuel. Then it will expand and much more acreage will be needed. But that won’t be hemp for cbd flower which is where I see the industry at

The industry was at that.

The price has dropped significantly but it will drop tremendously in a month. Until FDA gets involved and pushes out people who don’t know how to handle reg.

Everything is cyclical. Hemp is a revolution so no worries just survive this first drop and it will be easier to read the tides.

Buy low - sell high.

Everyone has bought high and is selling low for the past 7 months. As the tide recedes - I get to wade in the tide pools ![]()

![]()

I’m wondering what happens after the first crash when a bunch of companies are forced to liquidate. Does demand start to outpace supply again for a bit once back-stock dries up and there’s fewer farms and processors on the playing field? I mean, demand is still growing, and equilibrium doesn’t just spontaneously happen after a crash.

Yes, change is good for the market. It is when everyone starts getting REALLY innovative. Watch.

Ah yes, anecdotal evidence, the most informed and qualified of all evidence.

How about that placebo effect?