All Prices include the federal excise tax

I can move 190p or 200p food/usp grade ethanol all day in the low 20’s (excise tax included) plus shipping. Volume is not impacted by any restrictions - beit distiller license limitations, hand sanitizer ethanol demand, etc.

If interested, please message me here of send a DM. We’d love nothing more than to be able to significantly reduce your costs and increase your bottom line!

Price Range:

$22 - $30 per gallon plus freight

Packaging Types:

55 Gal Drum

270 Gal Tote

6,800 Gal Tanker

How much is a 270 gal tote

What’s the zip code for delivery? Where do you need the price to be? Feel free to email me too… kc@solvsource.com

$24/gal delivered plus sales tax… $25/gal includes freight, ethanol, and the federal excise tax. In other words, $6,750 delivered plus sales tax (8.75%) which is about $7,340 total.

I’d be shocked if anyone can even come close to that price.

sorry that was supposed to say $25 not $24

We get a tote for 4400 and others in here offering just as cheap with taxes

That’s great, you should take their price. You should make sure it all checks out - the product, the taxes being paid, etc. I move a LOT of beverage grade ethanol and never see prices this low.

1 Like

also, his tote say that it’s denatured with isopropyl. Two things, 1) you have to have an SDA permit to receive it 2) my price is for usp/kosher beverage grade ethanol (non-denatured) where there is a significant federal excise tax.

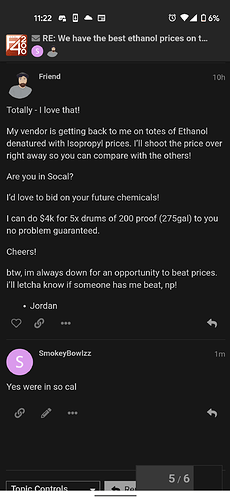

im aware the the 1400 dollar tax I buy 200k gallons a year you profit is just to high and he said he was gonna get back to me on the 190 denatures read the message he said 5x drums of 200 proof I just prefer 190 denatured with iso cause it can be even cheaper and works great but thank you!

I would be careful purchasing any amount of Ethanol below the standard Federal excise tax rates. any reduced tax rate is done through the CBMA craft beverage modernization act and is for excise tax associated with spirt and beverage manufacturing. As cannabis markets become more mainstream and the FDA starts to provide clear language - you will need to pay full excise tax and then file for Federal drawback as all regulated industries do currently. Food Flavor fragrance etc.